Last Updated on 21/10/2020 by Hrithik V

According to studies by PitchBook, there have only been 26 venture capital-backed IPOs in Europe, as compared to 70 in the US and 92 in China. It seems like European companies like TransferWire and Klarna would be offering shares in the public market soon. Though several tech companies have flourished in the past years, several startups in Europe have failed in the later stages of growth.

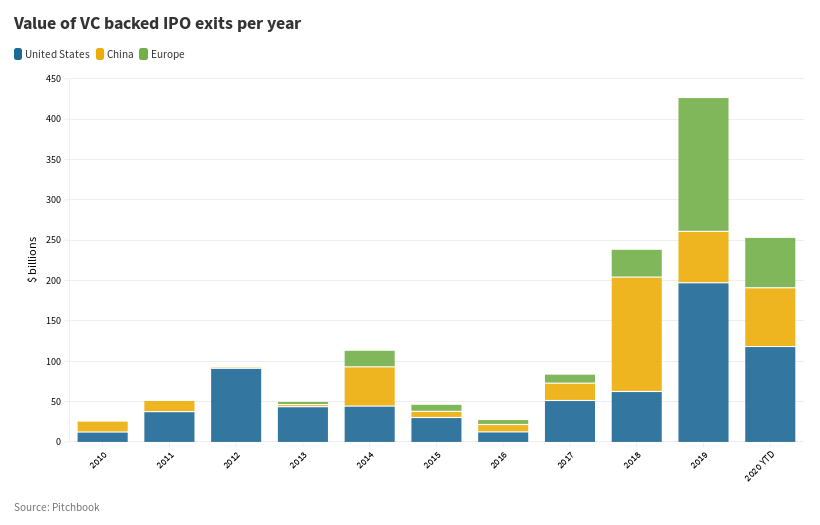

For the stock market in the US and China, several big tech names like Plantir and Ant Group have had a good debut year. However, Europe falls behind and has not seen many tech IPOs this year. A couple of years ago, big European names like Spotify, the music streaming company, and Adyen, the payments processor went public.

Tech IPOs in Europe have fetched a total value of just $6.7 billion year-to-date compared to $72.8 billion in China and $118.19 billion in the U.S. The U.K. e-commerce group The Hut Group, which debuted last month has been received well by investors, having received about $1.2 billion on the day of inception. However, an early backer of the company, Balderton Group admits that it has been a quiet year for European tech IPOs.

In an interview with CNBC, Suranga Chandratillake, a general partner at Balderton says, “There’s no doubt that European tech IPOs are behind the U.S. and Asia, that’s always been the way. We’ve seen a few good ones this year. I think there could well be more to come.”

Chandratillake has expressed her frustration over the lack of emerging European tech companies. There have been a few impressive flotations in the past, but nowadays, many choose to go public in the US, rather than in Europe. More firms are turning to New York, rather than London, Frankfurt, or Amsterdam.

Why is Europe far behind the U.S and China?

Research done by McKinsey has suggested that there may be underlying issues causing this disparity in the market. Analyzing the data from PitchBook, Europe has produced over a third of the world’s start-ups in the last decade but made up only 14% of the so-called “unicorn” companies with a valuation of $1 billion or more.

This brings forth the scalability problem – although the tech industry in Europe has developed a lot over the year, some start-ups cannot scale the later stages of growth and give in to obstacles in the form of financials and talent acquisition. According to McKinsey, European start-ups raised just 8% and 13% of the respective “Series D” and “Series E” late-stage capital captured by their U.S. counterparts.

Many European start-up founders object to the region’s rules regarding employee stock options, which allows staff to own shares in their own company. These laws are fragmented and less favorable as compared to the United States. McKinsey’s wrote, “These issues can make European start-ups more inclined to limit risk when pursuing exit strategies, including by spending too little on expansion.”

“In some cases, rapidly growing European start-ups may have factored concerns about their abilities to raise large amounts of follow-up capital into the decision to be acquired by U.S. competitors instead of trying to become global players on their own.”

Strong IPO Pipeline

There are several companies and organizations in Europe, which are very close to release shares into the market. A list compiled by European tech outlet Sifted put the money transfer platform TransferWise and cybersecurity firm Darktrace as potential candidates.

Another company, which is expected to go public is Klarna, which raised a hefty fund at a $10.6 billion valuation in the past month. The fintech firm’s CEO, Sebastian Siemiatkowski, told CNBC such a listing is unlikely for another two years. He expressed some admiration for Spotify’s unconventional route to market: a direct listing. For Klarna to get an eventual listing, he wants the firm to become a ‘household brand’ in the US, which would still take some time. It highlights a common prerequisite for many European start-ups: the need to gain an international presence before listing.

Missing out on ‘SPAC’

One of the most important things that the European companies did not follow was the way of ‘SPAC’, or special purpose acquisition companies. In the U.S, SPACs are blank-check firms, which raise funds to buy another business and bring it forth to the public. Separately in China, Shanghai and Shenzhen are competing for tech listings with Nasdaq-style boards.

In his statement to CNBC, Adam Kostyal, Nasdaq’s European listings head said that the existence of SPAC requires a particular type of investor and a clear structure. The European market lacks such a structure, and would not be able to support SPAC at the moment. He says that Nasdaq-run Stockholm stock exchange looks up to the U.S. structure, and wishes to adopt their methods.

How can Europe be at par?

Europe’s needs are very obvious – more tech IPOs. The higher the number of listings in the region, the easier would it be to create a “virtuous circle” of tech listings, industry analysts, and more investors.

“We are genuinely creating multi-billion dollar companies in Europe,” Chandratillake said. “We need to make sure they’ve got the opportunity to not just get their early-stage funding but late-stage funding in Europe and to go public in Europe.”

According to Kostyál, companies have been staying private for longer in both the U.S. and Europe as they’re still able to access capital in later stages of funding. “Hopefully the future has more to offer in terms of the transition from private to public.” However, several tech investors are optimistic about the region’s tech IPO prospects.

Jan Hammer, a partner at Index Ventures, told CNBC he feels that there is “a very healthy pipeline of IPO opportunities across the board.” He noted that one of this year’s big IPOs — video game software maker Unity — had been founded out of Denmark, while the market values of Spotify and Adyen are narrowing in on that of Uber’s. “We don’t view the IPO as an exit moment but a next step in the chapter of a company.”